| west bengal bhabishyat credit card scheme |

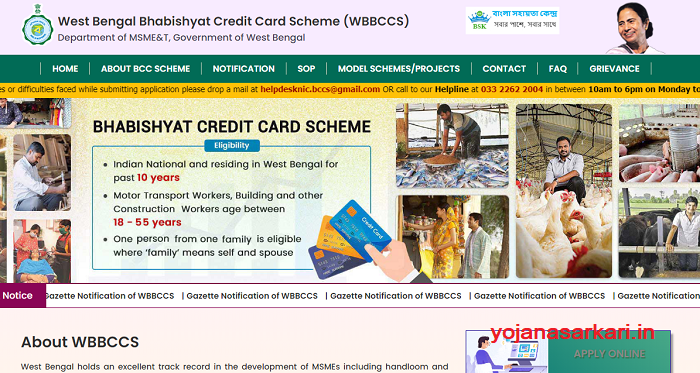

West Bengal Bhabishyat Credit Card Scheme:-

The West Bengal state government’s Bhabishyat Credit Card Scheme is a new initiative that gives loans of up to Rs 5 lakh with the state serving as a guarantee for prospective projects. This is a terrific opportunity for anyone who wants to establish their own business, and they may apply for the program online. To learn more about the WB Bhabishyat Credit Card Scheme 2023 read this article till the end.

West Bengal Bhabishyat Credit Card Scheme 2023

West Bengal Chief Minister Mamata Banerjee launched the Bhabishyat Credit Card Scheme 2023 during the budget presentation. The program was established to support impending state initiatives and to provide financial assistance to people in need. Because the government acts as a guarantee, the loan amount can be received with no security.

| Article About | Bhabishyat Credit Card Scheme Wb |

| Department | MSME&T Department |

| Initiated by | West Bengal Government |

| Beneficiary | Entrepreneur/ Business Owner |

| Objective | To Provide Loans up to Rs 5 Lakh |

| Scheme Date | 1 April 2023 |

| Official Website | bccs.wb.gov.in |

Bhabishyat Credit Card Scheme Objectives

The main objective of this scheme is to provide qualifying participants with credit cards so they may apply for loans for a variety of purposes, such as establishing a new business, growing an existing one, or fulfilling other financial obligations.

The program aims to encourage state youth to explore self-employment options. Starting a business can be successful and an income source. Many people wish to start their own businesses but lack the necessary funding. The West Bengal state government is presently offering loans to address this issue. Since the government would act as a guarantor under the scheme, loans can be disbursed without the requirement for a guarantee.

Eligibility Criteria

The Bhabishyat Credit Card Scheme eligibility criteria are as follows:-

- Applicants must be permanent residents of West Bengal.

- The scheme is launched for people who need financial assistance and want to start their own businesses.

- An authentic certificate from the applicant is required.

Important Note=> Only one member of each household may apply for the Bhabishyat Credit Card Scheme, and candidates must have lived in West Bengal for the past 10 years.

Required Documents

- Aadhar Card

- Ration card

- PAN Card

- Resident Certificate

- Business Performa

- Loan documents

- Recent passport-size photo

- Contact information

Bhabishyat Credit Card Scheme Application Process

To apply for the Bhabishyat Credit Card Scheme follow the steps given below:-

- First, go to the Official Website of the scheme.

- Now, find the WBBCCS online application link.

- After that, click on that link.

- Then, download the form.

- Now, fill out the form with the necessary information.

- Make sure to mention the correct contact details.

- After that, attach all the required documents.

- After completing the above process, send the completed application form together with all the required documents to the bank.

- If you complete the eligibility, the bank will assess your application and give you a credit card worth Rs 5 lakh.

Offline Application Process

To apply offline follow the steps given below:-

- The West Bengal Bhabishyat Credit Card Offline Application Form is available at the Department of MSME&T Office.

- Fill out the application form completely and properly.

- Attach all the necessary documents.

- Deliver the West Bengal Bhabishyat Credit Card Scheme Offline Application Form, along with all supporting papers, to the Department of MSME&T’s District Office.

- The Department Officers will review the submitted Application Forms and accompanying documentation.

- After that, you can collect your card at the Department of MSME&T Office.

Other Important Posts on Our Site

- WB Khela Hobe Scheme Announced for MGNREGS Card Holders, Know Full Details

- West Bengal Ration Card List 2023:পশ্চিমবঙ্গ রেশন কার্ডের তালিকা, Check [email protected]

- Didi ke bolo phone number 2023: দিদি কে বলো | West Bengal Online Complaint Registration

- Duare Sarkar Camp List 2023: Download New District Wise Camp List, West Bengal