YSR Zero Interest Loan Scheme | ap ysr zero interest loan scheme | ysr zero interest loan scheme apply online | ysr zero interest loan scheme application | ysr zero interest loan scheme ap | Andhra pradesh ysr zero interest loan scheme

YSR Zero Interest Loan Scheme has been launched by Andhra Pradesh Chief Minister Jagan Mohan Reddy. Through this scheme, interest-free loans will be provided to the women of the state. Nowadays, a large number of women are coming forward to set up various Self Help Groups (SHGs) and help society and encourage other women to become self-reliant. The scheme extends to women belonging to DWCRA (Development of Women and Children in Rural Areas) associations and affiliations.

In this article, we will share all the information related to the Andhra Pradesh YSR Zero Interest Loan Scheme like objectives, benefits, eligibility criteria, and application process of the scheme, etc. If you want to get all the information related to this scheme then read this article till the end.

YSR Zero Interest Loan Scheme

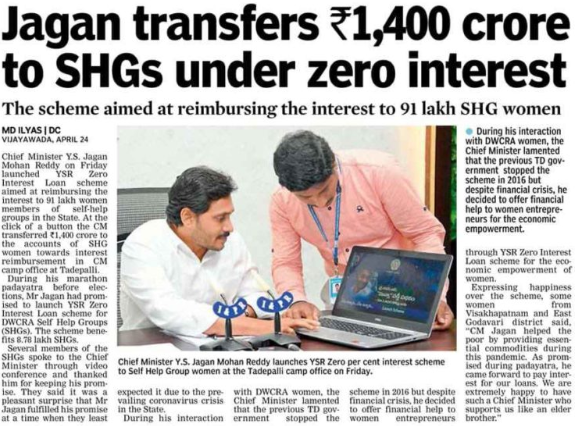

The Chief Minister of Andhra Pradesh Shri Jagan Mohan Reddy had promised this scheme to the general public during his election rallies. Cause of the coronavirus crisis and the pandemic that followed, there was great doubt among the public whether the promise would be fulfilled or not.

To everyone’s surprise, the CM kept his promise and transferred Rs. 1400 crore under the scheme for reimbursement of interest to over 91 lakh women belonging to Self-Help Groups and DWCRA federations. Around 8.78 lakh different self-help groups benefited from this scheme.

Andhra Pradesh YSR Zero Interest Loan Scheme mainly focuses on the development and economic empowerment of eligible and deserving women across the state. Under the scheme, an interest-free loan means a bank loan will be provided at zero percent interest to the list of selected beneficiaries. The interest amount of the loan will be borne by the government itself. Beneficiaries include hardworking and capable women from SHGs and DWCRA organizations.

| Name of the Scheme | YSR Zero Interest Loan Scheme(వైయస్ఆర్ జీరో వడ్డీ రుణ పథకం) |

| Launched By | CM Jagan Mohan Reddy |

| Beneficiaries | Women of DWCRA and Self-Help Groups (SHGs) |

| Objective | Economical Empowerment of Women of Andhra Pradesh |

| Official Website | ap.gov.in |

Implementation of the YSR Zero Interest Loan Scheme

AP YSR Zero Interest Loan Scheme will transfer the interest reimbursement amount to the bank accounts of the selected list of beneficiaries. In April 2020, AP CM Jagan deposited Rs 1400 crore under the scheme to benefit over 91 lakh eligible women SHGs. About 8.78 lakh women of SHG and DWCRA federations fully benefitted from this scheme. The women expressed their immense happiness and thanked the Chief Minister for helping them in such difficult times of the COVID-19 pandemic. This proved to be very beneficial for them financially to survive the coronavirus crisis.

AP YSR Sampoorna Poshana Plus Scheme Online Registration, Enrollment Procedure

YSR Zero Interest Loan Scheme Objectives

The main objective of starting the YSR Zero Interest Loan Scheme AP is to empower the women of the state financially and make them self-reliant. With this scheme, the women of the state will be provided with ample opportunities to create a better working environment and grow in their respective fields. The scheme mainly focuses on women belonging to Self-Help Groups (SHGs) and DWCRA (Development of Women and Children of Rural Area) associations. Beneficiaries who want to avail of financial loans from banks will be given loans at zero percent interest.

YSR Zero Interest Loan Scheme Benefits

- Under this scheme, all the selected beneficiaries will be able to get a bank loan at zero percent interest.

- Women or groups can use this cash to improve their existing strategies and policies.

- With improved policies and planning schemes, the administration of these groups and associations can be improved.

- Beneficiaries will not have to pay any interest on their appreciated loan amount.

Third Installment Of Zero Interest Scheme

The third installment of the zero interest scheme will be released by Chief Minister YS Jagan Mohan Reddy to women’s self-help groups during his visit to Ongole town. This installment will be released on 22 April 2022. The installment amount will be transferred to the bank account of the women beneficiaries. A public meeting will also be addressed by the Chief Minister at ABM College ground in Ongole town. This amount will be transferred through Direct Benefit Transfer. This scheme has been started to provide financial assistance to the women of the state. To take advantage of this scheme, the applicant must belong to a self-help group or DWCRA association of women

ప్రకాశంజిల్లా ఒంగోలులో నిర్వహించిన బహిరంగ సభలో స్వయంసహాయ సంఘాల బ్యాంకుఖాతాలకు వైయస్సార్ సున్నా వడ్డీ కింద రూ.1,261 కోట్లను బటన్ నొక్కి బ్యాంకులకు జమచేసిన ముఖ్యమంత్రి శ్రీ వైయస్.జగన్. pic.twitter.com/Ljxw70ejGx

— CMO Andhra Pradesh (@AndhraPradeshCM) April 22, 2022

YSR Zero Interest Loan Scheme Eligibility Criteria

- The applicant must be a resident of Andhra Pradesh state.

- An Applicant must belong to the self-help group or DWCRA associations of women.

- The applicant must have a working bank account number.

YSR Zero Interest Loan Scheme 2023 Online Application

- First, visit the Official Website of the YSR zero-interest loan scheme.

- The home page will open on your screen.

- On the homepage, click on apply now option.

- The application form will appear in front of you.

- In this application form, enter all the required details like your name, mobile number, email id, etc.

- Now upload all the required documents.

- Lastly, click on the submit option.