West Bengal Property Registration | Stamp Duty | Encumbrance Certificate | Application Process and Forms

West Bengal Property Registration :- The department that is responsible for property registration in the state of West Bengal is the Revenue Department. Department of Revenue looks after the services that are related to property like registration of documents and issue of encumbrance certificate. The parties can submit the application forms relating to property registration services at the Sub-Registrar’s Offices of Revenue Department, Government of West Bengal.

Today in this article we are going to discuss everything about West Bengal Property Registration like its objectives, benefits, required documents, eligibility criteria, stamp duty, encumbrance certificate, the application process, important highlights, etc. So to know more about West Bengal Property Registration stay connected with us.

West Bengal Property Registration

Property Registration in India is governed by the Registration Act of 1908. Registering your immovable property should be the top priority when you buy a house, shop, or land as it provides your legitimacy to carry out any transaction. A person is considered the legal owner of a property only after he gets the property registered in his name. The Department of Revenue is liable for property registration in the State of West Bengal.

Registration fees and stamp duty are not the same in all states of India so it’ll vary from state to state. The stamp duty is established on the agreement value or the market value and may vary from property to property and place to place. EC fees and document Preparation charges are other charges incurred.

| West Bengal Property Registration Highlights | |

| About | West Bengal Property Registration |

| State | West Bengal |

| Concerned Department | Department of Revenue |

| Benefit | Registration of Property will be done |

| Beneficiaries | Residents of the state |

| Official Website | Click Here |

West Bengal Property Registration Objectives

The main objectives of West Bengal Property Registration are as follows:-

- West Bengal Property Registration serves for the proper recording of documents which provides more authenticity.

- The basic purpose of registration is to record the ownership of the property.

- To ensure the prevention of fraud, conservation of evidence, and transfer of title to the owner.

- By registering property, the document will maintain an up-to-date public record.

- The document registration will be a permanent public record once it’s registered with the concerned office.

- Registration public records can be inspected by anyone.

Benefits of West Bengal Property Registration

The benefits availed under West Bengal Property Registration are as follows:-

- Registration of property helps for the proper recording of documents which provides more authenticity.

- By registering property, the document will maintain an up-to-date public record.

- To ensure the prevention of fraud, conservation of evidence, and the transfer of title to the owner.

Documents Required

Applicant needs to have the following documents to register themselves on West Bengal Property Registration:-

- Aadhaar card/voter card/PAN card/passport/driving license etc. of the parties.

- Address proof.

- Assessment slip containing the market value and chargeability of stamp duty and registration fees.

- PAN card or duly filled form 60

- Principal documents when the present document is supplementary to such principal documents.

- Particulars of stamp duty and registration fee payment.

- Permission from a competent authority in case of transfer of riot of any Scheduled Tribe person to a non-Schedule Tribe person.

Eligibility Criteria

The applicant needs to pass the following eligibility criteria to register themselves on West Bengal Property Registration:-

- Those who have landed in their names.

- Those who are legal heirs of the deceased landowner.

- Authorized signatory/ power of attorney.

Validity of West Bengal Property Registration

- The registration is valid till the land is sold to someone.

Stamp Duty

The stamp duty is the percentage of transaction value levied by the state government, on every registered scale. The rate of stamp duty and registration of immovable property registration in West Bengal is given below in pdf form:-

Click Here :- West Bengal Stamp Duty and Registration Charges

Stamp Duty in top cities of West Bengal

| Location of the property | Stamp duty for property less than Rs 25 lakhs | Stamp duty for the property above Rs 40 lakhs | Registration Charges |

| Howrah | 6% | 7% | 1% |

| Kolkata | 6% | 7% | 1% |

| Siliguri | 6% | 7% | 1% |

| Durgapur | 6% | 7% | 1% |

| Kharagpur | 6% | 7% | 1% |

How to Calculate Stamp Duty?

If the applicant wants to calculate stamp duty then click on the link given below:-

Encumbrance Certificate

An encumbrance certificate is a certificate that is important while applying for a mortgage loan, selling land, joint development, etc. The certificate certifies that the land does not have any legal dues. Offline process timing will be provided by the authorities, usually, it takes 15 to 20 days. The online process can be completed in two days.

Encumbrance Certificate Benefits

Benefits availed from the encumbrance certificate are as follows:-

- Encumbrance certificates play an important role in applying for a home loan from the banks.

- The Encumbrance Certificate is mandatory when one wants to buy or sell a property.

- It also acts as evidence that the property is free from legal liabilities.

- The encumbrance certificate ensures to know about the past transactions of property at the time of purchase of the property.

Documents Required

Applicants need to have the following documents to obtain their encumbrance certificate:-

- Aadhaar Card

- Application form

- Property card if available

- Address proof of applicant (attested copy)

- Property address. survey number, document/ Patta number

- Period for which the EC is required

- Applicable fees

- Copy of sale deed of the said property

- The purpose for which the EC is applied for

- Copy of Power of Attorney, in case of application, is made by the attorney holder

How to get your Encumbrance Certificate?

Follow the following steps to get your Encumbrance Certificate for West Bengal Property Registration:-

- To apply for an Encumbrance Certificate, the applicant has to go to the respective sub-registrar office where the land is registered.

- Then the applicant needs to collect the application form for the Encumbrance Certificate at the respective sub-registrar office.

- Fill in the form carefully with details and submit the same with a non-judicial stamp affixed along with the required documents to the respective authority as advised. Do crosscheck it.

- Authorities will announce the fees to be paid. Please pay as advised

- A Receipt containing an Acknowledgement ID is issued to the applicant.

- This application request will be processed by the department.

- SMS is sent to the applicants informing the status of the application.

- As per the notification, the applicant shall visit the office to collect the certificate.

Application Process for Property Registration

Follow the following steps to register yourself for West Bengal Property Registration:-

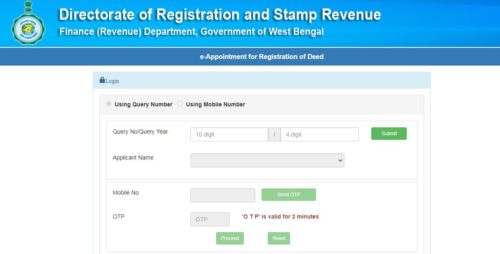

- Firstly the applicant needs to visit the official website.

- On the right side of the page under E-services you’ll see the e-Requisition Form Filling option, you need to click on that. Then the applicant needs to fill out the following form.

- Now, the e-assessment slip and the amount of mutation fee payable will also be generated.

- After this, the applicant has to make payment for stamp duty and registration fee by entering a query number and query year.

- At last click on the Check query status button.

- Enter your query number and query year and click on the “submit” button.

- The applicant is requested to present the Deed at proper registration offices along with an e-assessment slip, proof of payment, token for the queue, etc. before the appropriate registration officer.

- After this, the system will generate the serial number of a deed.

- Now, performs e-payment and captures the applicant’s photo, fingerprint, and signature.

- Scanning deed for verification and approval by the registration officer with digitally signed signature.

- Then, at last, the applicant will receive the registered Deed, and which can be downloaded online from the website.

Contact Details

If the applicant comes across any query then she can get help from the following details:-

- e-Mail ID: [email protected]

- Contact Number: 033-2225 9145

- e-Deed Helpline: 9932325995/9732573133

Do read our other articles on our website:-Click Here

Note:- How did you like the information provided by us, please let us know in the comment section. For more details of any other scheme stay connected with us at https://yojanasarkari.in/. Thank you.