UYEGP Scheme:- UYEGP or Unemployed Youth Employment Generation Program is started by the Tamil Nadu Government to encourage and help the resident of Tamil Nadu to start their own business or venture. Under this scheme, the state government will provide a subsidy on the loan amount taken by applicants to start their businesses.

Today in this article we will provide the complete details about the UYEGP Scheme such as eligibility, documents required, objectives, benefits, how to apply for it, etc so that it will be easier for you guys to understand and apply for the scheme so be with us till the end of the article.

UYEGP Scheme

- The Department of Micro, Small, and Medium Enterprises, Government Of Tamil Nadu has started the UYEGP Scheme.

- There are a lot of people who have the potential to start and run their business successfully but due to financial issues they have to face various problems so to help all those residents of Tamil Nadu, this scheme is started.

- Under this scheme, the state government will provide a subsidy of 25% of the loan amount taken by applicants to start their businesses.

- Under this scheme, applicants get loans from various financial organizations for loans, including nationalized banks, private banks, and Tamil Nadu Industrial Co-operative Bank.

- The applicant can take a loan upto Rs 15 lakhs.

- The applicant gets a loan of less than Rs 10 lakhs without any collateral and if the loan amount is more than 10 lakhs then the applicant has to provide collateral security.

-

- Rs. 15.00 Lakhs For Manufacturing Sector

- Rs.5.00 lakhs For the Service Sector

- Rs.5.00 lakh For Business Sector.

| About | UYEGP Scheme |

| Started By | Government Of Tamil Nadu |

| Concerned Department | Department of Micro, Small, and Medium Enterprises |

| Objective | To Provide Loans And Subsidies For Businesses To Low-Income Citizens. |

| Beneficiary | Residents Of The Tamil Nadu |

| Subsidy Amount | 25% Of The Total Project |

| Official Website | Click Here |

Objectives Of The UYEGP Scheme

The objectives of the UYEGP Scheme are as follows:

- To reduce unemployment in the state.

- To uplift the social and economic conditions of the people of economically disadvantaged sections by providing them a chance to become self-employed.

- To provide financial help to the people who want to start their service, manufacturing, and business enterprises.

Key Features And Benefits Of The UYEGP Scheme

- UYEGP Scheme is introduced by the Department of Micro, Small, and Medium Enterprises, Government Of Tamil Nadu.

- Under the Unemployed Youth Employment Generate Programme 10% of the Project Cost for the General Category is the Promoter’s contribution and 5% of the Project Cost for the Special Category is the owners’ contribution.

- Under this scheme, the state government will provide a subsidy of 25% of the project’s maximum Project Costs.

- The applicant gets a loan of Upto Rs Rs.15.00 lakh.

- The interest rate offered under the UYEGP scheme is as per the RBI guidelines.

- The applicant has to go for courses in the Entrepreneur Development Program (EDP) for seven days for the recipients of the scheme.

- The loan will be provided by various financial organizations for loans, including nationalized banks, private banks, and Tamil Nadu Industrial Co-operative Bank.

- CGTMSE offers loans up to Rs. 10 lakhs without the need for collateral or security from the borrower.

- The General Managers of the respective District Industries Centre will conduct frequent buyer-seller meetings to provide marketing support.

Eligibility

The eligibility criteria for the Unemployed Youth Employment Generate Programme are as follows:

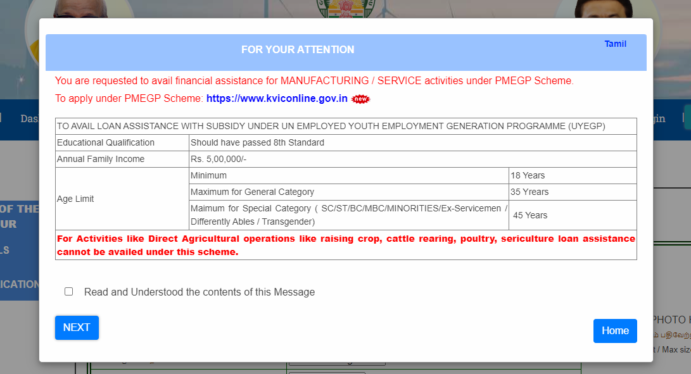

- Applicant must have passed at least 8th class.

- The age of the applicant should be 18+, for general categories the age limit is 35 years, and for special categories, the age limit is 45 years.

- Special categories include the applicants from SC/ST/BC/MBC/MINORITIES/Ex-Servicemen / Differently Ables / Transgender community.

- The annual income of the applicant’s family should be less than Rs 500000.

- The applicant should be a resident of a minimum of 3 years in the same area.

- The applicants must not have taken any kind of loan before.

- Applicant must have taken the EDP training, it is required for a UYEGP loan.

- The recipient must not have received a State/Central Government loan or subsidy to apply for UYEGP.

Documents Required For UYEGP Scheme

The following documents are needed to apply for the Unemployed Youth Employment Generate Programme:

- Identity Proof

- Project report

- Residential proof

- Caste certificate (if needed)

- Handicapped (if required)

- A quote for the necessary resources included in the project.

- Educational qualification certificate.

- Passport size photo

- Mobile Number

How To Apply For The Unemployed Youth Employment Generation Programme?

- First of all, you have to visit the official website of the UYEGP Scheme.

- On the home page, you have to click on Scheme then from the drop-down list click on UYEGP.

- Now a new page will open on your screen.

- Now click on Apply Online then from the drop-down list click on New Application.

- Now tick on the read and understood box and click on next.

- Now on this page, you can check the list of documents you have to submit at the time of application.

- Again tick on the read and understood box and click on proceed.

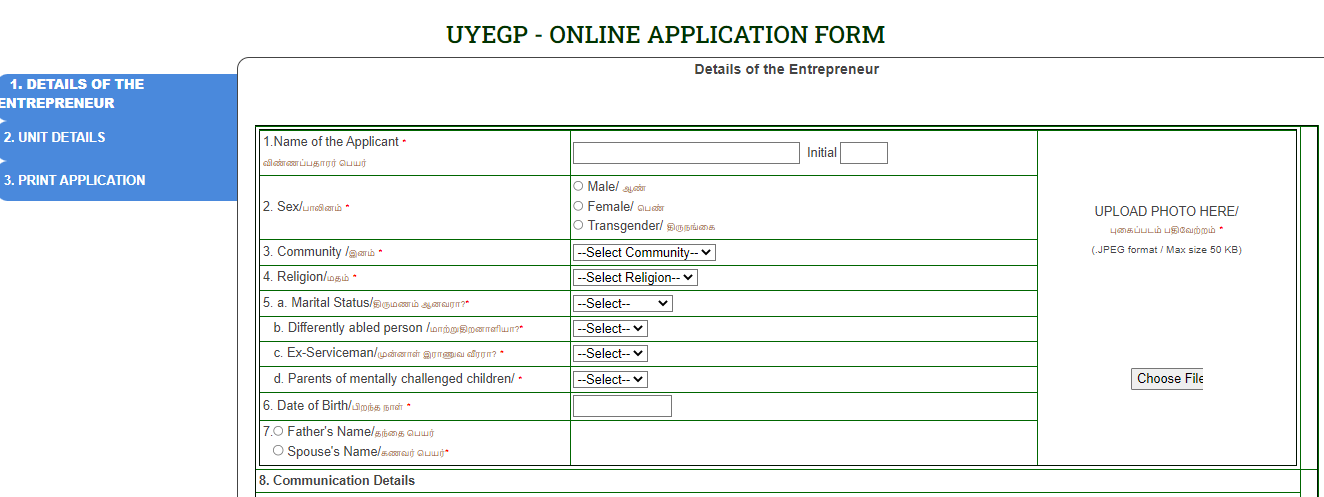

- Now the application form will open on your screen.

- Fill in all the details asked in the application form carefully i.e.

- Personal details

- Residence details

- Marital status

- Community Details

- Aadhar card details

- Qualification details

- Project details, etc.

- Now you can go through the list of documents to be uploaded.

- After filling out the application form click on proceed.

- Now you will get an application ID, and save it you will need it for your future use.

- Upload Document

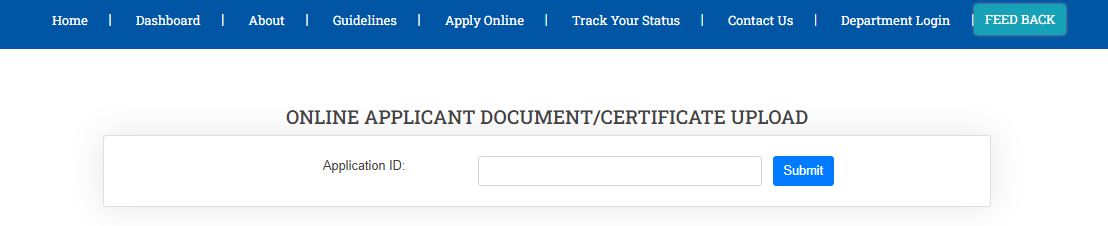

- Now it is the 2nd phase of the application form in which you have to upload the document.

- Now click on Apply Online then from the drop-down list click on Upload document.

- Enter the application and click on submit.

- Now upload the scanned copy of the document asked i.e

- Passport size photo

- Transfer Certificate

- Ration Card

- Residence Proof – Aadhaar Card/Voter’s ID

- Copy of Quotations with GST Number ( if it is more than one page scan it into one file)

- Community Certificate

- Proof of Differently abled/Ex-serviceman/Transgender

- The size of the file should be 50 kb and less

- After uploading all the documents click on submit.

- Now DIC will verify whether the applicant is eligible or not. On verification, the applicant will receive a call letter to attend an interview.

- If the applicant qualifies for the interview, the recommendation for sanctioning the loan will be sent to the concerned bank.

- The bank will approve the loan. The applicant will receive a call letter to attend the EDP training.

- Applicants need to submit the EDP training certificate. The affidavit should be typed in a Rs.20/- Non-Judicial Stamp Paper duly Certified and Signed by the Notary Public and then submit the affidavit along with a copy of the Rental or Lease Agreement to the bank while sanctioning the loan.

How To Check The Application Status Of the UYEGP Scheme?

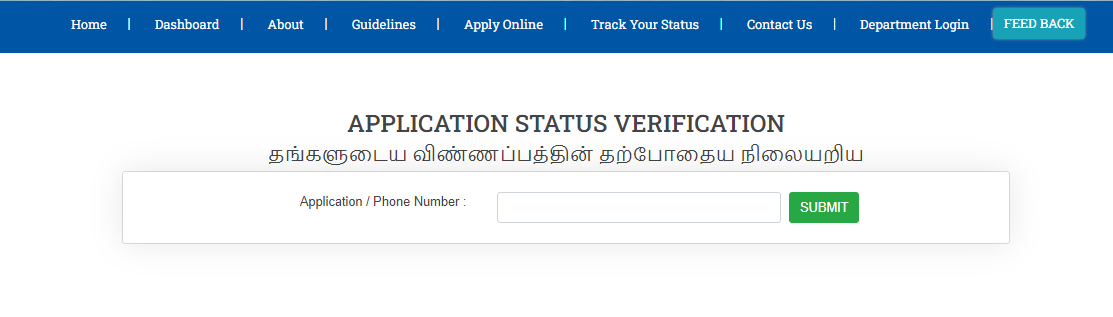

- First of all, you have to visit the official website of the UYEGP Scheme.

- On the home page, you have to click on Scheme then from the drop-down list click on UYEGP.

- Now you have to click on track your status.

- Enter the application number or Phone number. and click on submit.

- Now the complete details of the application will be displayed on your screen.

NOTE:- Stay connected to our website Yojanasarkari for information about any scheme related to the Central Government and State Government scheme

FAQ

What is the UYEGP Scheme?

Total cost project means a loan taken by the applicant to start their own business.

What are UYEGP Eligibility Criteria?

2. The age of the applicant should be 18+, for general categories the age limit is 35 years, and for special categories, the age limit is 45 years.

3. Special categories include the applicants from SC/ST/BC/MBC/MINORITIES/Ex-Servicemen / Differently Ables / Transgender community.

4. The annual income of the applicant’s family should be less than Rs 500000.

5. The applicant should be a resident of a minimum of 3 years in the same area.

6. The applicants must not have taken any kind of loan before.

7. Applicant must have taken the EDP training, it is required for a UYEGP loan.

8. The recipient must not have received a State/Central Government loan or subsidy to apply for UYEGP