Jharkhand Property Registration | Online Registration Delhi Property | Jharkhand Property Registration Application Procedure

If you are a resident of Jharkhand and want to know about the Jharkhand Property Registration then read the article carefully. The department of Registration and Stamp is responsible to register property in the Jharkhand. Under the Indian Registration Act, 1908 registration of any kind of property is mandatory.

Today in this article we will provide you the information about the Jharkhand Property Registration such as the purpose of registering property, objective, Stamp duty and registration fees, How to calculate stamp duty, Documents Required, Application Procedure, etc for all types of information related to the Property registration in Jharkhand be with us till the end.

Jharkhand Property Registration

According to the Indian Registration Act, 1908 registration of property in India is mandatory. The Department of Registration and Stamps is responsible for property registration in the state of Jharkhand. Transfer of immovable property has to be registered to get the property rights on the execution date of the deed. Registration of property serves as a document that certifies the authenticity of the owner of the property.

| Jharkhand Property Registration Highlights | |

| Article | Jharkhand Property Highlights |

| Concerned Department | Department Of Registration |

| Beneficiary | Resident Of Jharkhand |

| Objective | Registration Of Property |

| Official website | Click Here |

Jharkhand Registration Act

According to Section 25 of the Registration Act, 1908, all the documents related to the registration of the deed should be submitted to the registrar’s office within 4 months from the date of registration. In case of any of the above violations, payment with a penalty of 10 times the property registration fee should be remitted in such a case of property registration.

Purpose Of Property Registration

The purpose of Andhra Pradesh Property Registration are as follows:-

- To maintain the registration records of the daily registering property of the state.

- Fraud prevention, protection of evidence, ensuring transfer of title to the owner.

- To incur publicity for the transaction.

- To determine if a property has already been sold or not.

- Facility to provide protection of title deeds and to prove titles if the original deeds are lost or destroyed.

Documents Required

The following documents are required at the time of applying for the Jharkhand Property Registration:

- Aadhar Card.

- Identity Proof such as voter card/PAN card/passport/driving license etc.

- Address Proof.

- Duly filled Form 60.

- Assessment slip containing the market value and charge-ability of stamp duty and registration fees.

- Details of stamp duty and registration fee payment.

- In case of any Scheduled Tribe person rioting a non-Scheduled Tribe person then they have to take permission from the competent authority

- Passport size.

Jharkhand Stamp Duty And Registration Fees

Stamp duty is a tax imposed by the state government on the sale of property/property ownership. Stamp duty and registration fees for different transactions in Jharkhand are given below:

| Description of Instrument | Stamp Duty Fee | Registration Fee |

| Adoption Deed | Rs.42 | Rs.1000 |

| Agreement | Rs.3.50 | Rs.1000 |

Bond

|

|

3% of the value of the document. |

| Conveyance(sale deed) | 4% of the value of the document. | 3% of the value of the document. |

Gift

|

|

3% of the value of the deed. |

| Mortgage | 4.2% of the value of the head. | 2% of the value of the deed. |

| Partition | The same duty as a bond. | 3% of the value of the deed. |

| Partnership | Rs.42 | Rs.1,000 |

| Trust(Declaration of) | Rs.47.25 | Rs.1,000 |

| Power of Attorney. | Rs.31.50. | Rs.1,000 |

| Will | Nil | Rs.1,200 |

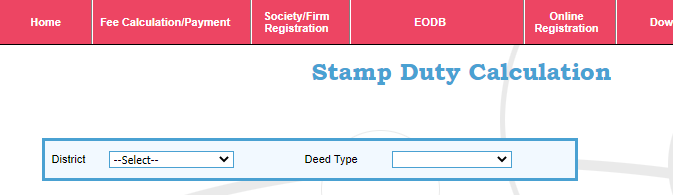

How To Calculate Stamp Duty On e-Nibandhan Portal

To calculate the stamp duty online on the e-Nibandhan portal you have to follow the given procedure:

- First of all, you have to visit the e-Nibandhan web portal.

- On the home page of the portal, you have to click on Stamp Calculate.

- Now a new page will open on your screen.

- Then you have to select district, Deed Type.

- Now minimum stamp duty will be displayed on your screen.

Procedure To Obtain E-Stamp Online

- To get the e-stamp online, firstly you have to visit the e-SHCIL web portal.

- Then you have to log into the portal.

- Then click on e-stamping and make the necessary steps to obtain E-Stamp.

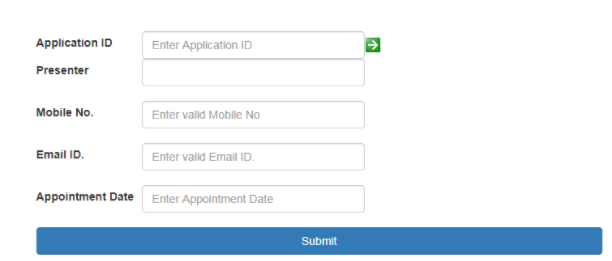

How To Apply For Deed Registration Appointment Slot

- To get or apply for the appointment slot, you have to visit the e-Nibandhan web portal.

- Then on the home page of the portal, you have to enter the enter Application ID, Presenter, Mobile number, email id, Appointment date.

- Now a form will be open on your screen.

- After filling in all the details click on Submit.

- After taking an appointment you have to visit the sub Tehsil office or the SRO office.

Procedure For registering A Deed

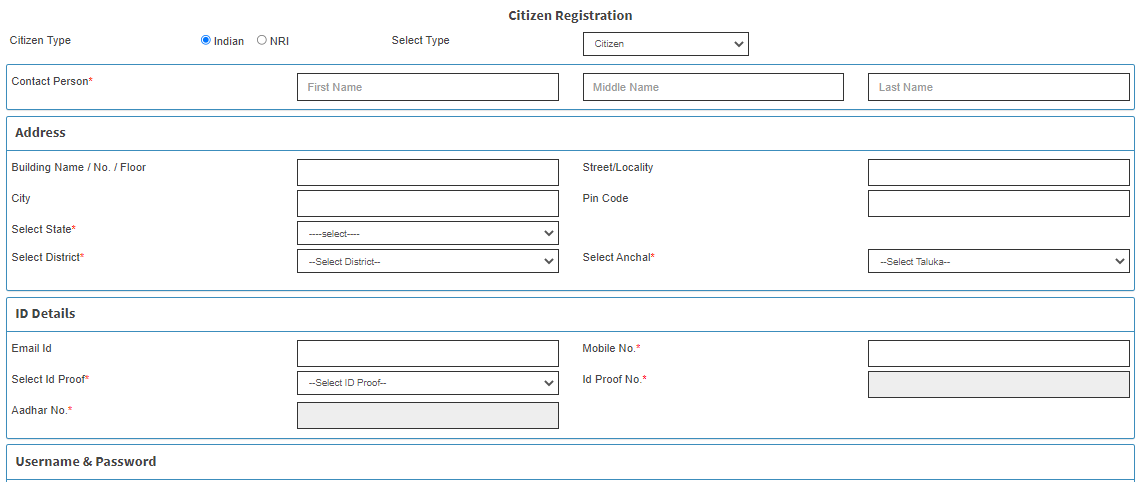

User Registration

- First of all, you have to visit the e-Nibandhan web portal.

- Now on the home page, you have to click on Online Register.

- Then from the drop-down list click on Pre-Register.

- Then on Citizen Section, click on the Register.

- Now a form will open on your screen.

- Now fill in all the details asked in the form carefully such as Name, Address, Id details, etc, and click on Submit.

- Now you have to select the application type and then click on Proceed for Online Application.

- Then select SRO and click on NEXT.

- Now you have to enter the necessary document details such as the type of deed, etc.

- Then enter the value of the property stamp value.

- After filling in all the details click on Next.

- Now a new page will be open.

- Now you have to enter the parties’ details on this page.

- After filling in all the details click on Next.

- Now on this new page, you have to enter the property details like Anchal name, Thana name, Plot type, the category of land.

- And after filling in all the details click on Next.

- In case of keeping any other property, other property details have to be entered.

- The records entered will be verified and after verification, a “number of khata” will be generated.

- Then you have to enter the Khata number on the screen and click on Ok.

- Now Fee Calculation page with fee detail will open on your screen.

- You can take the printout of the Check Slip and click on finish.

- Now Application Id will be generated and you will be allowed to make an online payment.

- And at last, by clicking on Click Here option registration Process will be finished.

You have to submit the check slip with the documents to the Sub Registrar Office on the time of your booked appointment slot.

After verification your document will be forwareded to the registered title deed and you have to apply to the Municipal Authority seeking mutation of title to the property.

Contact Details

- Phone Number: 0651-2446066

- Email: [email protected]

Note: How did you like the information provided by us on the Jharkhand Property Registration, please let us know in the comment section. For more details of any other scheme stay connected with us on YojanaSarkari. Thank you.