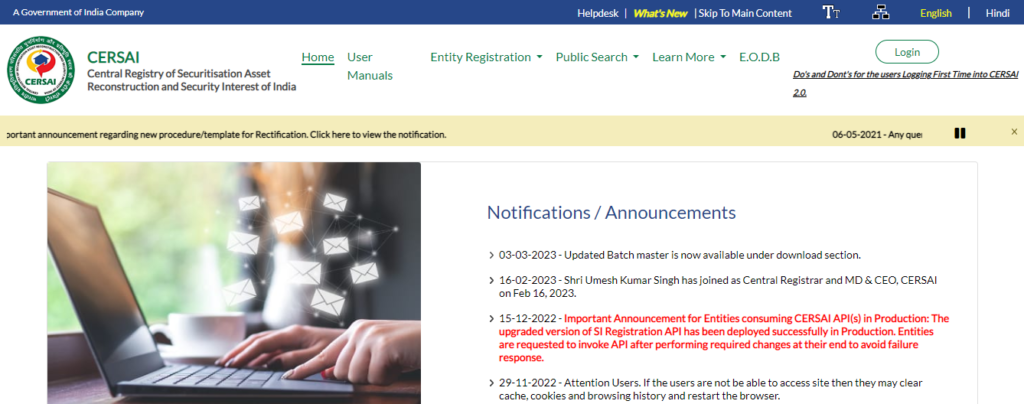

CERSAI Portal | cersai.org.in | CERSAI charges | CERSAI kyc |

The Government of India has developed the CERSAI portal. CERSAI full form is Central Registry of Securitisation Asset Reconstruction and Security Interest of India. This portal was created to prevent fraud in situations where properties are used as collateral for loans. As per Section 20 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act of 2002, the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) was established (SARFAESI Act).

Section 25 of the Companies Act of 1956 grants it a license. Through this article, we will share the complete information related to the CERSAI Portal Highlights, Purpose, CERSAI Ownership, Features of CERSAI, Steps to Login, Organization Registration, Registration Fee, Benefits, etc. If you are interested to get information related to this portal If you want then read this article till the end.

What is CERSAI Portal?

CERSAI was formed as a government company under the Companies Act 2013. The headquarters of CERSAI is in New Delhi. CERSAI was created with the aim of preventing fraud related to mortgages. In many cases, the fraudsters used to take loans from multiple banks on the same property. The CERSAI Registry helps in checking such cases. CERSAI is a majority-owned company by the central government, public sector banks (PSBs), and the National Housing Bank (NHB). CERSAI portal registration is covered under the Securitization and Reconstruction of Financial Assets and Security Interest Act, 2002 (SARFAESI Act).

Earlier, it was very difficult for financial institutions to know about the encumbrance on a property. Due to the fragmented registration mechanism, it was very difficult to know whether a property was mortgaged or not, and it was known only to the owner of the property. In the absence of CERSAI (Cersai login), the genuine buyers were also unaware of the loans and liabilities attached to the property.

This resulted in legal hassles and difficulties for the buyers of such properties. The CERSAI portal can be used by both financial institutions and the public. However, the general public can only access details related to equitable mortgages.

| Article About | CERSAI |

| Full Name | Central Registry of Securitization Asset Reconstruction and Security Interest of India |

| Established by | Government of India |

| Purpose | Preventing mortgage fraud |

| Official website | cersai.org.in |

Latest Updates:- CERSAI

PFRDA allows joining the scheme using the CKYC repository managed by CERSAI

In a recent development, the Pension Fund Regulatory and Development Authority, or PFRDA has simplified the process of joining the schemes launched by it. PFRDA has allowed paperless onboarding using the CKYC repository managed by CERSAI. CKYC is a central repository by the government that allows users to complete their KYC once and they can interact with multiple stakeholders.

Who is the Owner of CERSAI?

CERSAI is an entity owned by the central government, the National Housing Bank, and a group of public sector banks. While 51 percent stake (majority stake) is held by the central government, the rest is held by a consortium of banks and NHB.

Key functions of CERSAI

The key functions and objectives of the CERSAI mechanism are:-

- CERSAI was formed to maintain a central registry of equitable mortgages or collateral. This includes information on the asset used as collateral, the name of the financial institution that has disbursed the loan, and details of the borrower.

- CERSAI has enabled lenders to register asset reconstruction and securitization transactions.

- CERSAI portal allows lenders (public sector banks and non-banking financial companies) to ascertain that the property against which they are lending has not been used by any other bank as collateral for another loan.

- Even if the property is used as collateral elsewhere, banking institutions may find that the value of the property is sufficient to extend another loan.

- The CERSAI portal allows homebuyers to verify whether the property they are going to buy is free from any encumbrances and security interest.

- The scope of CERSAI was changed in 2012 through the Factoring Act, 2012. Through this act, CERSAI introduced registration of security interests created through factoring or account receivables.

- The scope of CERSAI was extended in 2016. Through this amendment, CERSAI is required to introduce registration of security interests created on movable and intangible assets such as book debt, hypothecation, and account receivables.

- CERSAI is empowered to register all types of mortgages used throughout India.

How does the CERSAI Portal help homebuyers?

Before the introduction of the Real Estate (Regulation and Development) Act, of 2016, there were limited avenues for property and real estate developer verification. Home buyers were duped on the pretext of false promises and fraud. However, after the introduction of the CERSAI portal, potential home buyers can check whether the property they have shortlisted is free from any encumbrances or used as collateral for the loan. This not only saves homebuyers money but also saves them from tedious legal hassles in the future.

How does TReDS use CERSAI?

TReDS (Trade Receivables Discounting System) is an electronic platform for discounting trade receivables of Micro, Small, and Medium Enterprises (MSMEs). It uses the Central Registry of Securitization Asset Reconstruction and Security Interest (CERSAI) of India for the generation of a unique identifier for MSME borrowers, known as ‘CERSAI ID’. This ID helps in the efficient tracking of the credit history of the borrower and facilitates faster onboarding to the TReDS platform. CERSAI provides a centralized database of all registered security interests in movable and immovable properties, making it easier for financial institutions to assess the creditworthiness of MSME borrowers.

CERSAI Registration Charges

CERSAI charges a fixed fee for the registration of security interest. The fees depend on the loan amount disbursed against the property. The fee for CERSAI registration varies from Rs 50 to Rs 100.

| Nature of Transaction | Fee payable (Excl. Tax) |

| Satisfaction of any existing Security Interest | NIL |

| Satisfaction of registration on the realization of the receivables | NIL |

| Search for information in CERSAI | Rs.10 |

| Assignment of Receivables | Rs.10 for the assignment of receivables of less than Rs.5 lakh and Rs.100 for the assignment of receivables of Rs.5 lakh and above. |

| Satisfaction of securitization or reconstruction of financial assets | Rs.50 |

| Creation or modification of Security Interest in favor of secured creditors / Other Creditors | Rs.100 for a loan above Rs.5 lakh and Rs.50 for a loan up to Rs.5 lakh. |

| Securitization or reconstruction of financial assets | Rs.500 |

| Condonation of delay up to 30 days for Assignment of Receivables | Ten times the basic fee, as applicable. |

What is CERSAI Search?

Due to the increasing incidence of loans being availed from different banks using the same property as collateral, a prospective buyer can do a CERSAI search to be doubly sure. A CERSAI search will enumerate the details of a property and if it has been mortgaged against the loan. To conduct a CERSAI search, you can log in to the CERSAI portal and click on the ‘Public Search’ tab on the home page.

CERSAI search can be done in the following ways:-

- AOR Based Research

- Asset-Based Research

- Debtor Based Research

How to do asset based search on the CERSAI portal?

Follow the steps given below to perform asset based search on the CERSAI portal:-

- Visit the official website of CERSAI.

- Click on the Public Search button on the homepage.

- From the drop-down list, select Property-based search.

- On the newly opened window, select the asset category from the drop-down list.

- Asset options are immovable, movable, and intangible.

- When you select a fixed category, a series of options will appear.

- Fill in the following details:-

- Survey Number / Municipal Number (Comma will be treated as a separator)

- Plot Number

- House/ Flat Number

- Floor No.

- Building (Tower Name / Number

- Name of the Project / Scheme / Society

- Street Name / Number

- Locality/ Sector

- State

- District

- City / Town / Village

- Pin Code

- Enter the Captcha code.

- Click on the Submit button.

NOTE:- Apart from asset-based search, one can also do a debtor-based search and AOR-based search. If you do not want to do a property-based search, you can get the required information from other searches on the CERSAI portal.

How to do CERSAI Login? (Step-by-step)

CERSAI Login is a facility to log in or access the Central Registry of Securitization Asset Reconstruction and Security Interest of India portal. CERSAI login enables a user to access the database of CERSAI, as updated by authorities such as banks and other institutions. Using the CERSAI login, the general public can conduct a property-based search in the Central Register by paying a nominal fee. In addition, the CERSAI login also enables the general public to conduct debtor-wise searches in the Central Register by paying the requisite fee.

CERSAI login is mandatory for both the general public and representatives of banking or financial institutions to access the database. To CERSAI login Follow the steps given below:-

- Visit the official website of CERSAI.

- On the homepage, click on the CERSAI Login button.

- A new CERSAI Login window will open.

- If you are a registered user on the CERSAI portal, enter the Login Id (CERSAI Login), Password, and Captcha Code.

- Lastly, click on the Login option.

How to do Entity Registration on CERSAI

For Entity registration on the CERSAI portal, the user needs to follow the steps given below:-

- First, visit the official website of CERSAI.

- The homepage will open on your screen.

- Click on the Entity Registration tab followed by the Entity Registration.

- A new page will open on your screen.

- Now, select the Mode of Entity Registration i.e.,

- CKYC

- Digital Signature

- After that, enter all the required details.

- Finally, enter the captcha code and click on the Submit button.

FAQs Related to CERSAI

Why is CERSAI registration required?

CERSAI is the registry of mortgaged properties and the banks can verify whether a property is already mortgaged when one applies for a loan.