Mahila Samman Savings Certificate | Mahila Samman Bachat Patra Benfits | How To Apply For Mahila Samman Certificate | Investment options for women | Mahila Samman Bachat Patra Saving Account

The government of India has started the Mahila Samman Savings Certificate (MSSC) to make women of India financially independent and stable. Today in this article we are going to discuss everything about the Mahila Samman Certificate Scheme like its eligibility criteria, required documents, objectives, benefits, important highlights, the application process, etc. So to know more stay connected with us.

Mahila Samman Saving Certificate (MSSC)

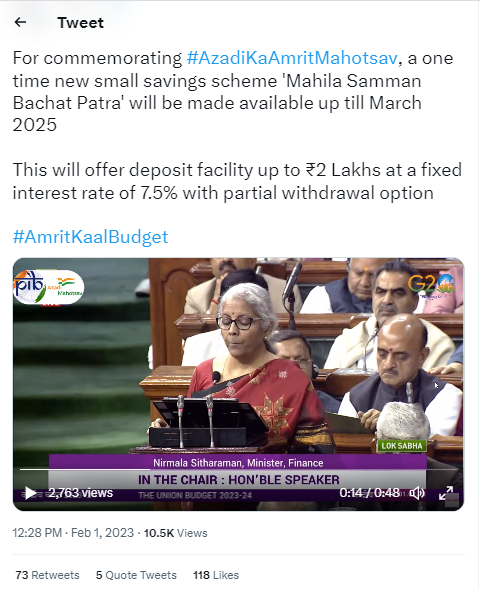

Mahila Samman Saving Scheme was announced by Union Finance Minister Smt Nirmala Sitharaman in her budget speech 2023-24. To celebrate the Azadi ka Amrit Mahotsav, the Mahila Samman Certificate scheme was announced. This is a one-time small saving, women and girls are only eligible for this scheme. This scheme is only available for investment for two years, from April 1, 2023, to March 31, 2025. After this time, you will be unable to invest in this scheme.

Under this scheme, the investor will earn a fixed interest of 7.5%. As it is a government-backed scheme so it is completely secure to invest in this scheme. The minimum amount that you can invest in this scheme is Rs.1000, and the maximum deposit amount in one account is Rs.2 lakh.

Mahila Samman Saving Certificate Latest Tax Update

According to the latest Central Board Of Direct Tax notification(CBDT), you do not have to pay any TDS if the interest earned from investing in the Mahila Samman Savings Certificate does not exceed Rs 40,000 per year. With a 7.5 per cent annual interest rate, a maximum investment of up to Rs 2 lakh will earn an interest income of Rs 15,000 in the first year and Rs 32,000 in the second. TDS is not applicable in this instance because the interest income is less than Rs 40,000.

Section 80C of the Income Tax Act of 1961 does not apply to the Mahila Samman Savings Certificate. This means that account holders will not be able to claim a tax exemption on their investments.

| About | Mahila Samman Savings Certificate MSSC |

| Started By | Central Government |

| Started On | 1 February 2023 |

| Objective | To Empower Women Financially |

| Beneficiary | Women Of India |

| Scheme Tenure | 2 Years |

| Maximum Investment | Rs 2 lakhs |

| Official Website | Not Announced |

| Central Government Offical Website | Click Here |

Objective Of Mahila Samman Savings Certificate MSSC

The objectives of the Mahila Samman Bachat Patra Scheme are:

- To provide financial security and empower women by encouraging them to save and invest.

- Helping women achieve financial independence and stability.

Key Points & Benefits Of The Mahila Samman Savings Certificate (MSSC) For Women

- Financial independence: Mahila Samman Certificate Scheme is a government-backed small savings scheme for women which helps women to achieve financial independence and take their own financial decisions.

- Tax savings: Under this scheme, tax benefits will be provided to the beneficiaries on deposit.

- Safety and security: Since Mahila Samman Savings Patra is a government-backed scheme, residents can open their savings accounts and invest in them without any worries.

- Better returns: Under this scheme, a fixed interest rate of 7.5% will be offered to beneficiaries on their saving scheme for 2 years which will give them higher returns at the end.

- Easy To Open: Interested Beneficiaries can open the Mahila Samman Bachat Patra Scheme by visiting their nearest bank. The process of opening a savings scheme is simple and easy.

- Provides a secure future: This scheme provides women with a secure future by providing assured returns on their investments after the maturity date.

Click here To Read About : ABHA ( Ayushman Bharat Health Account Card)

Eligibility Criteria

- Any woman who is a citizen of India is eligible for this scheme.

- Beneficiaries above 18 years of age can open Mahila Samman Savings Account.

- In the case of minors, the guardian can open the account on behalf of the girl.

- There is no upper age limit and women of all ages can avail the benefits of this scheme.

Documents Required for Mahila Samman Savings Certificate Account

- Application form

- KYC documents, such as an Aadhaar card, Voter ID, driving license, and PAN card

- KYC form for new account holders

- Pay-in-Slip

Mahila Samman Savings Certificate Interest Rate

This scheme offers a fixed interest rate of 7.5% per year, which is significantly higher than most bank Fixed Deposits (FDs) and other popular modest savings plans.

Premature Closure of Mahila Samman Savings Certificate

Investors can close the Mahila Samman Savings Certificate account before two years in the following situations:

- You can close the MSSC account after six months of opening without giving any reason. In such a case, an interest of 5.5% will be given.

- On the death of the account holder.

- In case of extreme compassionate grounds, like

- critical illness of the account holder

- Death of the guardian on the production of relevant documents. In this case, interest will be paid on the principal amount.

How to Open a Mahila Samman Savings Certificate?

- First of all, visit the official website of the Indian Post and download the application form or you can download it from the given link.

- With the application form visit your nearest post office.

- Now fill in all the details asked in the application like:

- Fill out the Post Office address under the ‘To The Postmaster’ section.

- Mention the account as ‘Mahila Samman Savings Certificate’.

- Fill out the account type, payment, and personal details.

- Fill out the declaration and nomination details.

- After completing the application form attach it with the documents and submit it to the post office.

- You can deposit the amount in the Post Office through cash or cheque.

- In last, you will get a certificate that serves as proof of investment in the Mahila Samman Savings Certificate scheme.

How To Calculate Mahila Samman Savings Certificate

If you are investing Rs 2lakhs in the Mahila Samman Certificate Scheme and you are getting an interest fixed at 7.5% yearly. The Interest you will earn in 1 year will be Rs 15000. Let’s see how interest is calculated.

Interest = Principal Amount× Interest Rate

Interest= 200000 * 0.075

Interest= 15,000

If you invest 2 lakhs in this scheme, you will receive 15,000 per annum in interest. You will receive Rs 32,000 in interest after two years.

NOTE:- Stay connected to our website Yojanasarkari for information about any scheme related to Central Government and State Government.

FAQ

What is Mahila Samman Savings Certificate?

Mahila Samman Savings Patra is a unique savings scheme for women in India. Under this scheme, the Government of India provides a 7.5% interest rate on savings accounts for 2 years.