Income Tax Portal Login | Income Tax Return 2023 | How To Fill Income Tax Return Online | ITR login | Income Tax Return Form 16 | eFiling Income Tax Return

Income Tax Portal Login: Every year, lakhs of taxpayers apply online for income tax returns. The process Of filing an Income Tax Return online is an easy, simple and stress-free procedure and but it can be confusing sometimes. In this article, we will provide complete details on ITR, What is Income Tax Return, why it’s important, how to file ITR and the Income Tax Portal Login Procedure.

File Income Tax Return

ITR filing stands for Income Tax Return. The primary purpose of ITR is to declare the total income earned by an individual during the financial year. According to the new Income Tax Rule, individuals whose annual income is less than Rs 7 lakh do not have to pay any tax. It is mandatory to pay income tax for every individual, HUF, company, firm, association of persons, body of individuals, and every person earning income during the financial year in excess of the tax-exempt limit.

ITR can also be used as income proof of the taxpayer. It can be used in various places like for applying for loans, visas, etc. Applications for ITR 2023-24 start in May.

| About | eFiling Income Tax Return Online, ITR login |

| Concerned Authority | Income Tax Department, Government Of India |

| Started On | April |

| Last Date | July |

| Objective | To File Income Tax Return |

| Beneficiary | Residents Of India |

| Official Website | Click Here |

Why Is ITR Important?

- To determine the tax liability of the taxpayer

- To keep a record of the income of the taxpayer

- To avail of loans and other financial services

- To avoid penalties and legal consequences for not filing ITR

Who Are Eligible To File ITR?

Any individual, Hindu Undivided Family (HUF), company, firm, association of persons, body of individuals, or any other person who has earned income during the financial year in excess of the tax-exempt limit is eligible to file Income Tax Return.

Documents required For File Income Tax Return Online

For filing IT return online, the following documents are required:

- Pan card

- Form 26AS

- Form 16A, 16B, 16C

- Salary Pay slips

- Bank statements

- Interest certificates

- TDS certificate

- Proof of tax-saving investments

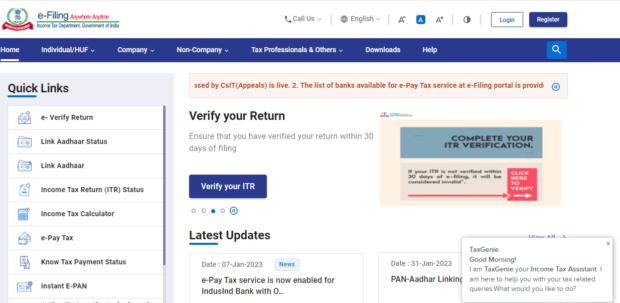

Income Tax Portal Login

To login into the Income Tax Portal follow the simple steps given below:-

If you are already registered into Income Tax Portal Login then follow these steps:

- First of all, visit the official website of the IT Department e-filing ITR Login portal.

- Enter your credentials( Pan Number) to log in to your account.

- Now confirm your secure access message and enter the password.

- Now click on skip and you will be directed to the dashboard of the portal.

If you are new to the Income ITR Login portal then follow these steps:

- To register into the e-filing portal, you must have to follow documents:

- Valid PAN

- Valid Mobile Number

- Valid Current Address

- Valid Email Address, preferably your own

- Now visit the official website of the IT Department e-filing portal.

- On the homepage, click on Register.

- Now enter the PAN number and click on validate.

- Now a form will open, fill in all the details asked in the form such as Name, DOB / DOI, Gende, Residential Status, and Basic Details as per your PAN, and click on continue.

- Now the Contact Details page for Individual Taxpayers will open. Enter your contact details including your primary mobile number, email id, and address.

- After completing the form click on continue.

- You will receive OTP on your mobile number and email ID, enter the separate received OTPs and click Continue.

- Now verify the entered details again and click on Confirm to submit the form.

- Now set your password, and a personalized message, and click Register.

- Now you are successfully registered into the portal and can apply for the ITR.

How To File Income Tax Returns Online?

- First of all, you have to visit the official website of the Income Tax e-Filing portal.

- Enter your login credentials and click on continue.

- Now click on the e-File menu and click the File Income Tax Return.

- PAN will be auto-populated, you have to select the following things:

- Assessment Year

- ITR Form Number

- Filing Type as Original/Revised Return

- Select Submission Mode as ‘Prepare and Submit Online

- Now click on continue.

- You need to select the appropriate verification option in the Tax Paid & Verification tab. Select any one of the following options to verify the Income Tax Return:

- I would like to e-Verify

- I would like to e-Verify later within 120 days from the date of filing.

- I do not wish to e-verify and wish to send the signed ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru – 560 500” through normal or speed post within 120 days from the date of filing.

- Now click on the ‘Preview and Submit’ button, verify all the data entered in the ITR, and click on Submit.

- On selecting the option I would like to e-verify, e-verification can be done by any of the following methods by entering the EVC/OTP.

- EVC generated through Bank ATM or Generate EVC option under My Account

- Aadhaar OTP

- Prevalidated Bank Account

- Prevalidated Demat Account

- The EVC/OTP must be entered within 60 seconds, or else the Income Tax Return (ITR) will get auto-submitted. The submitted ITR should be subsequently verified using the option ‘My Account > E-Verify Return’ or by sending the signed ITR-V to the CPC.

- On selecting the other two verification options, the ITR will be submitted but the ITR filing process is not complete until it is verified. The submitted ITR should be subsequently e-Verified using the option My Account > E-Verified Return’ or the signed ITR-V should be sent to CPC, Bengaluru.

How To Fill The Income Tax Return Offline?

- First of all, you have to visit the official website of the Income Tax e-Filing portal.

- On the homepage, you have to click on download.

- Now select the financial year and then click on utility and download it.

- Extract the downloaded utility zip file and open the utility from the extracted folder.

- Now fill in all the details asked in the ITR form.

- Validate all the tabs in the ITR form and calculate tax.

- You have to generate and Save the XML.

- Now login to the portal and click on the e-File menu and then click Income Tax Return.

- PAN will be auto-populated, you have to select the following things:

- Assessment Year

- ITR Form Number

- Filing Type as Original/Revised Return

- Select Submission Mode as ‘Prepare and Submit Online

- Now click on continue.

- You need to select the appropriate verification option in the Tax Paid & Verification tab. Select any one of the following options to verify the Income Tax Return:

- Digital Signature Certificate (DSC).

- Aadhaar OTP.

- EVC using Prevalidated Bank Account Details.

- EVC using Prevalidated Demat Account Details

- Already generated EVC through My Account Generate EVC Option or Bank ATM. The validity of such EVC is 72 hours from the time of generation. I would like to e-verify later. Please remind me.

- I do not wish to e-verify and wish to send the signed ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru – 560 500” through normal or speed post within 120 days from the date of filing.

- After selecting one of the options click on continue.

- Now you have to upload the ITR XML File and select DSC as the verification option and attach the signature file generated from the DSC Management Utility.

- Select Aadhar OTP as a verification option, Enter the OTP received in the mobile number registered with UIDAI.

- On selecting EVC through a Bank account, Demat account, or Bank ATM as a verification option, you have to enter the EVC received in the mobile number registered with Bank or Demat Account respectively.

- On selecting the other two verification options, the ITR will be submitted but the ITR filing process is not complete until it is verified. The submitted ITR should be subsequently e-Verified using the option My Account > E-Verified Return’ or the signed ITR-V should be sent to CPC, Bengaluru.

- At last click on submit ITR.

How To Check Income Tax Refund Status?

- First of all, visit the official website of the e-Filing Portal, Income Tax Department.

- On the homepage, Click on Income Tax Return (ITR) Status.

- Enter your acknowledgement number and a mobile number and click Continue.

- Enter OTP received on your mobile number and then click on submit.

- Now you will be able to view the ITR status.

NOTE:- Stay connected to our website Yojanasarkari for information about any scheme related to Central Government and State Government.

FAQ

What is the minimum income to file ITR?

Who are eligible to file ITR?

Documents required to file Income Tax Return Online?

Form 26AS

Form 16A, 16B, 16C

Salary Pay slips

Bank statements

Interest certificates

TDS certificate

Proof of tax-saving investments